Quanta G-Type for Gunbot, created by Dave.

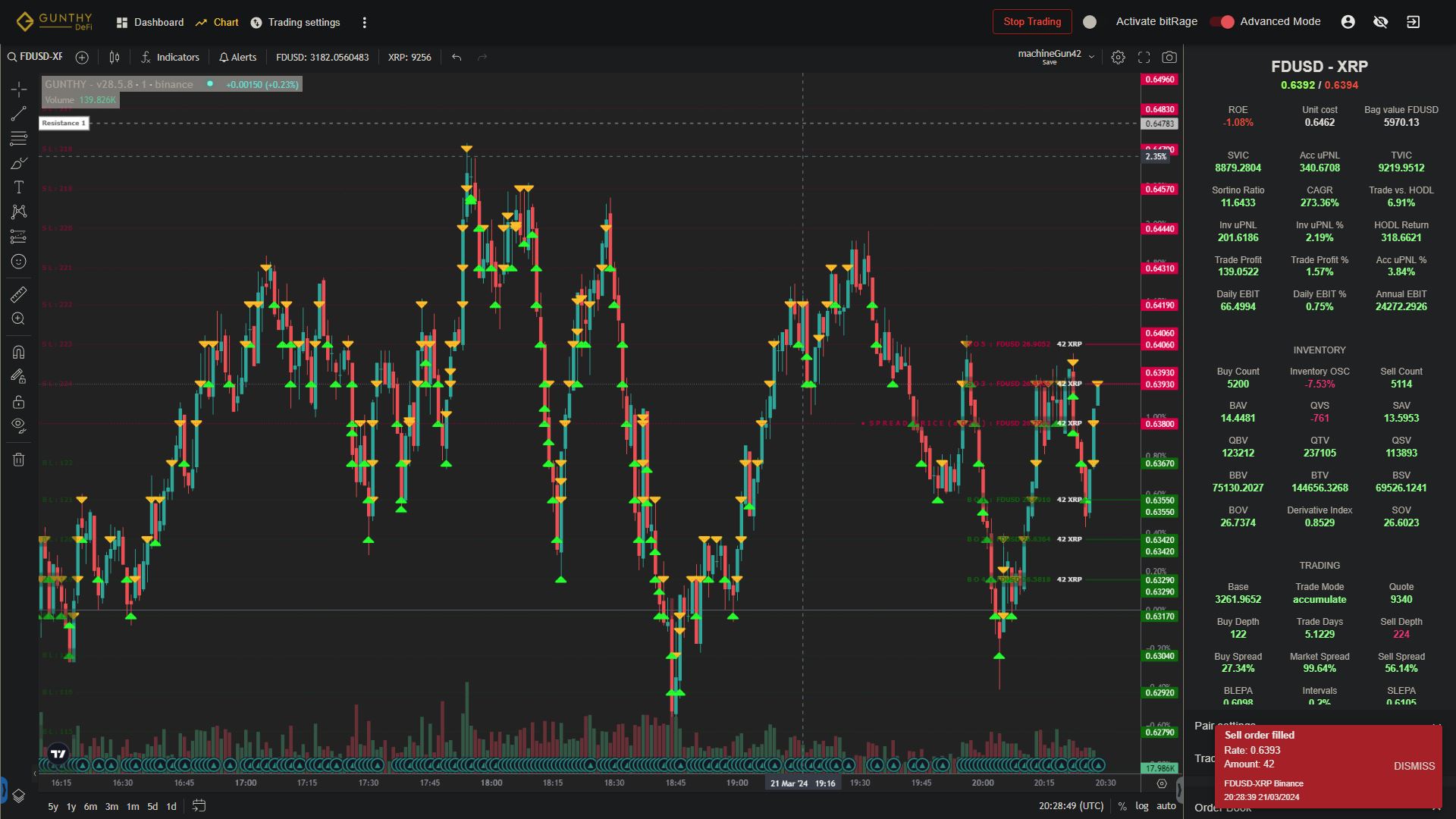

In this talk, we’ll plunge into the intricacies of the strategy known to us as QG. A favorite for its simplicity and effectiveness. The Quanta G-Type strategy is a geometric market maker hybrid designed for effective market making. Designed to bootstrap and trade over a long horizon in very large market price movements, In the (100’s to 1000’s% price moves). A quantitative algorithm is very different to a technical analysis algorithm.

How does Quanta-G Type operate?

Quanta-G requires a minimal setup using just a few variables. These settings will ultimately determine the operation of the bot. These include an upper and lower trading range, as well an interval as a percentage. Quanta-G will trade 24/7 as long as the price stays within the trading range. The interval adjusts the size of the grid as a percentage. Your wallet balance, interval and trading ranges are the key factors to Quanta-G. This will also conclude you trading limit per the algorithm.

Quanta-G will initially do a market order once the software has been started. This allows the bot to sell each interval to the upper range. The additional funds allow the bot to trade down to the lower range.

Quanta-G does not inherently operate as a simple “GRID” bot. Designed as a market maker/hybrid the algorithm adjusts the trading limit to work for our advantage, depending on the market sentiment. The user is able to override these settings, by selecting a different mode manually.

Quanta-G Type - Trading Modes

- "ACCUMULATE” means trade limits are placed in FDUSD and will profit in BTC in a matched trade. This means if it can, based on wallet and the market, it will try and save a little BTC behind rather than realise it all. If that cannot happen, it will act normal like in DECUMULATE.

- “DECUMULATE” means trade limits are placed in BTC and will profit in FDUSD in a matched trade.This means each buy/sell will use the same “quote” in the trading limit. (Behaving like a pure scalp)

- “REBALANCE” If SOV is greater than BOV, trade state can change to accumulate FDUSD as part of the auto compounding and inventory management function. This means if activated, the bot will start using the BOV and SOV Price. The BOV is the buy value and SOV is the sell value.

- “HODL” HODL Mode is a separate mode that when enabled, will only allow accumulation until price reaches higher than the previous high.

If the BOT is in AUTO-MODE it will change the modes by itself based on the algorithm.

As an always in strategy, it performs to a markets 3 states.

- In a Sidewards Market, profits are made by Spread trading.(Making profits from the buy and sell interval)

- In a Price Pump. We will perform a decumulation of assets when conditions are right.

- In a Price Dump an Accumulation of assets when conditions are in our favor.

Is this strategy for you?

Market bootstrapping is a long game, making dumps fun and it loves volatility over massive ranges. This is a long term strategy with a long trading time horizon, meaning it’s for traders who want to set and forget and are focused on long term investment and return. If you like fast action or find yourself swapping quote coins every 5 minutes, this might not be for you. You can however make this ultra aggressive but it will require significant starting capital, not for the faint hearted.

We have a Link to the QG calculator, so you can see the triangle of market range, spreads and capital required. It's a google sheet, open it, right click on Gunbot Quanta G-Type Setup and make a copy to new spreadsheet and it will open in your own account. It's self explanatory, but if you run into any problems, let me know, I'll be more than happy to help.

How are profits generated?

Profits come from 3 functions:

- Spread Profits. The price derivative of spread trading (small)

- Accumulation of Spread Derivative. Using excess quote from spreads to increase sell interval values (medium).

- Inventory Swing. Automatic management of inventory between upper and lower bounds (large)

So what are my risks?

Due to the trading time horizon, choose a coin you have high confidence will still be around for a year plus. You will be trading all market seasonality. The biggest risk is if price falls below lower bounds. We mitigate this by trading massive ranges but it's important to get setup right. This means that you will get spread trading gains on the way down which will offset a little against decreased inventory value. I have personally set very low intervals of 0.1%, acting like high frequency trading. I must say, I do like it and trading profit gains can be higher in a flat market. This would of course require free fee's with an interval that low. Such as FDUSD on Binance.

REMEMBER: In any market, during long declines, the effect of market making is to decrease losses, NOT to realise actual profits.

Operational features of Quanta-G Type

- Auto compounding. Trade profits perpetually added back to trading range

- Auto inventory management. Flipping profits in either quote or base.

- Auto buy and sell sloping of limit order value. (Highest first on both buy and sell sides around price midpoint. profits increase the trading limit from the middle down and up to bounds).

Quanta-G Type has In-depth and comprehensive performance indicators showing all aspects of the strategies performance. Including, HOLD vs Trade comparison, clear uPNL breakdown and projected annualised wallet growth). with a Very light API weight, this strategy catches up with market prices and triggers limit orders.

Exchange refresh of 2-10mins is fine (dependant on the volatility of your trading pair. Higher price volatility, lower refresh rate) - this means you can stack a VPS full of instances. Operational Depth Control allows the user to ensure you always catch large volatile moves.

Trading Modes - Summary

- Auto mode. Conditional behavior which will flip between accumulation, decumulation and re-balance.

- Accumulation mode. sell orders have the same base value as buy orders, (profit comes in quote).

- Decumulation mode. Sell orders have the quote value as buy orders, (profit comes in base).

- Re-balance Mode. Sell orders have the quote value as buy orders, (profit comes in base).

- HODL Mode is a separate mode that when enabled, will only allow accumulation until price reaches higher than the previous high.